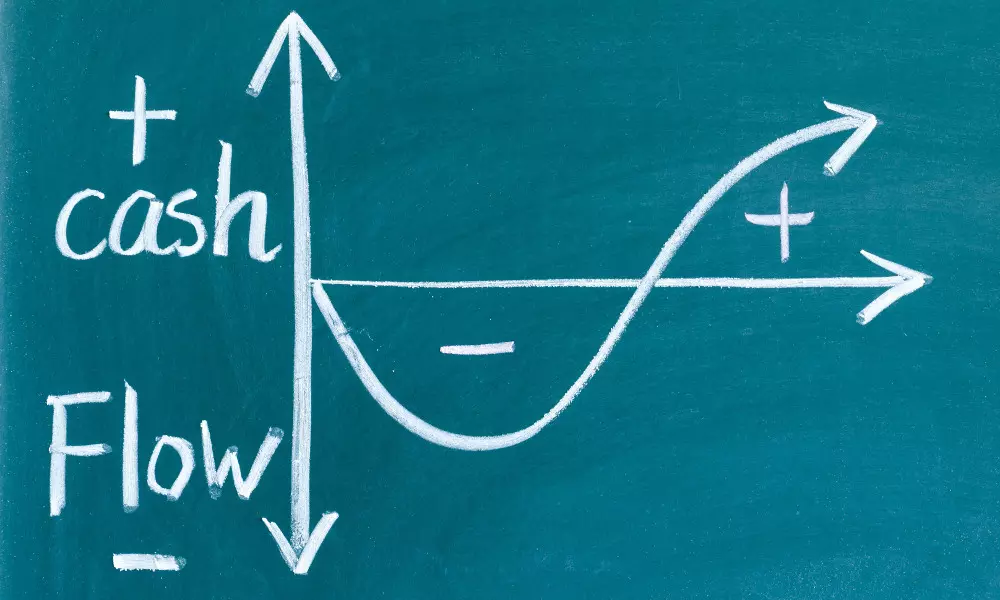

People can experience cash flow problems for various reasons, and these issues can affect individuals, businesses, and organisations.

Common reasons why people might have cash flow problems:

- Irregular Income: People with irregular income sources, such as freelancers or seasonal workers, may struggle with cash flow when they have periods of low or no income.

- High Fixed Expenses: When individuals or businesses have high fixed expenses (like rent, mortgage, or loan payments), they may find it challenging to cover these costs during months with lower income.

- Unplanned Expenses: Unexpected or emergency expenses, such as medical bills or home repairs, can disrupt cash flow if there are insufficient savings or emergency funds.

- Slow-Paying Clients/Customers: Small business owners or freelancers may face cash flow problems if their clients or customers delay payments or are consistently slow payers.

- Poor Financial Planning: Inadequate financial planning, budgeting, or failure to anticipate future expenses can lead to cash flow issues. Without a clear financial strategy, it is easy to overspend or underestimate costs.

- High Debt Levels: High levels of debt, including credit card debt or loans can strain cash flow due to monthly interest payments and principal repayments.

- Market Fluctuations: Businesses that are sensitive to market fluctuations, such as changes in commodity prices or demand for certain products/services, may experience cash flow problems during economic downturns.

- Ineffective Inventory Management: Businesses that carry excessive inventory or struggle to sell their products may tie up cash in unsold goods, affecting cash flow.

- Overhead Costs: High overhead costs, including employee salaries, utilities, and maintenance, can strain cash flow if revenue doesn’t cover these expenses.

- Inefficient Accounts Receivable Management: Businesses that do not have effective accounts receivable management systems in place may experience delays in collecting payments from customers, impacting cash flow.

- Tax Obligations: Failure to plan for and meet tax obligations can lead to penalties and tax-related cash flow problems.

- Economic Downturns: External factors, such as economic recessions or global crises (e.g., the COVID-19 pandemic), can significantly impact cash flow for both individuals and businesses by reducing income or disrupting supply chains.

- Lack of Reserves: Insufficient emergency savings or a lack of access to credit can make it difficult to navigate unexpected financial challenges.

- Poor Credit Management: A low credit score or a history of late payments can limit access to credit when needed, exacerbating cash flow issues.

- Personal Spending Habits: For individuals, overspending, living beyond their means, or accumulating unnecessary debt can lead to cash flow problems.

To address cash flow problems, individuals and businesses should prioritise financial planning, budgeting, and effective cash management strategies. This might involve reducing expenses, increasing income, building emergency funds, and seeking professional financial advice when necessary. Talk to us immediately if you need assistance before it’s too late.

SUBSCRIBE

To stay up-to-date with the latest news and insights in taxation, business, and finance, subscribe to our newsletter The Balance. By subscribing, you will receive valuable information and helpful resources to support your financial journey.

We’d love to hear from you.

North Melbourne

Ground Level

124 Errol Street

North Melbourne VIC 3051

P: 03 9888 3175

Level 2, Suite 10

622 Ferntree Gully Road

Wheelers Hill VIC 3150

P: 03 9888 3175

Fill out the form below and someone from the team will get back to you shortly

This form collects your information so that we can better serve you. We will never sell your information to any third party. By submitting this form you agree to subscribe to our newsletter and receive the latest news in taxation, business and finance. You can unsubscribe at any time. View our full Privacy Policy.