by Financially Sorted | Sep 1, 2023 | Business, Small Business, Tax & Accounting

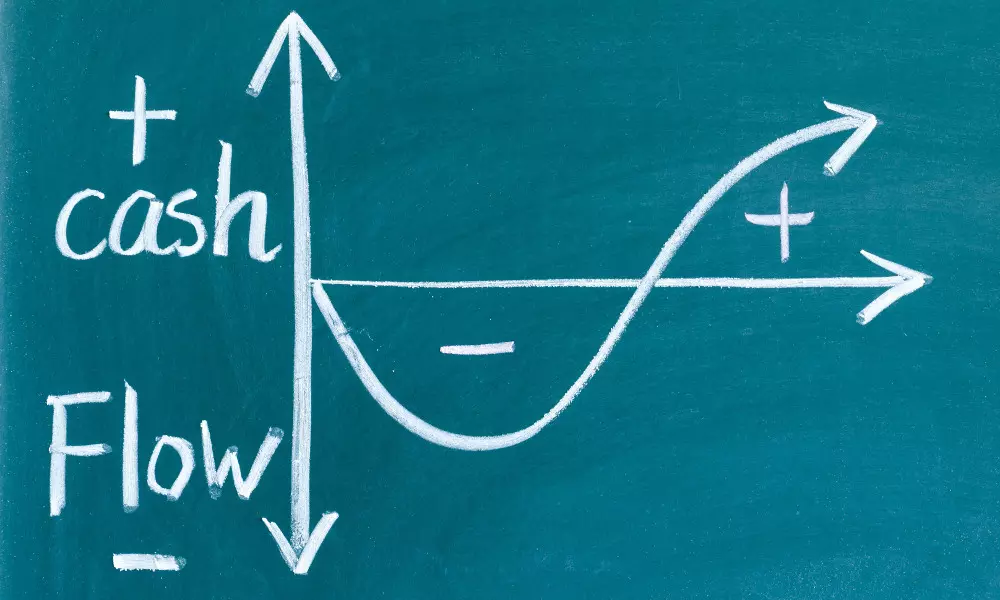

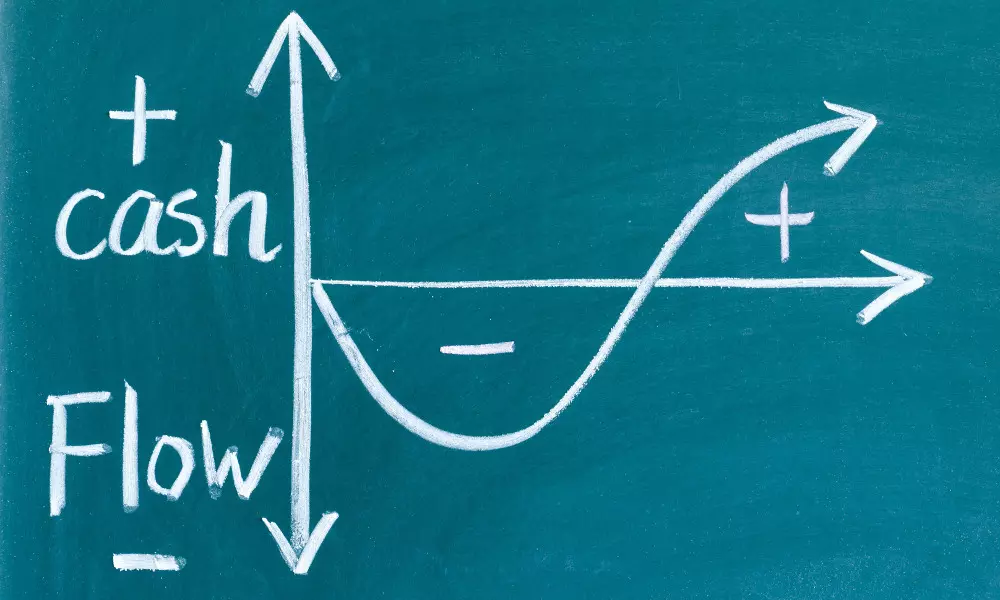

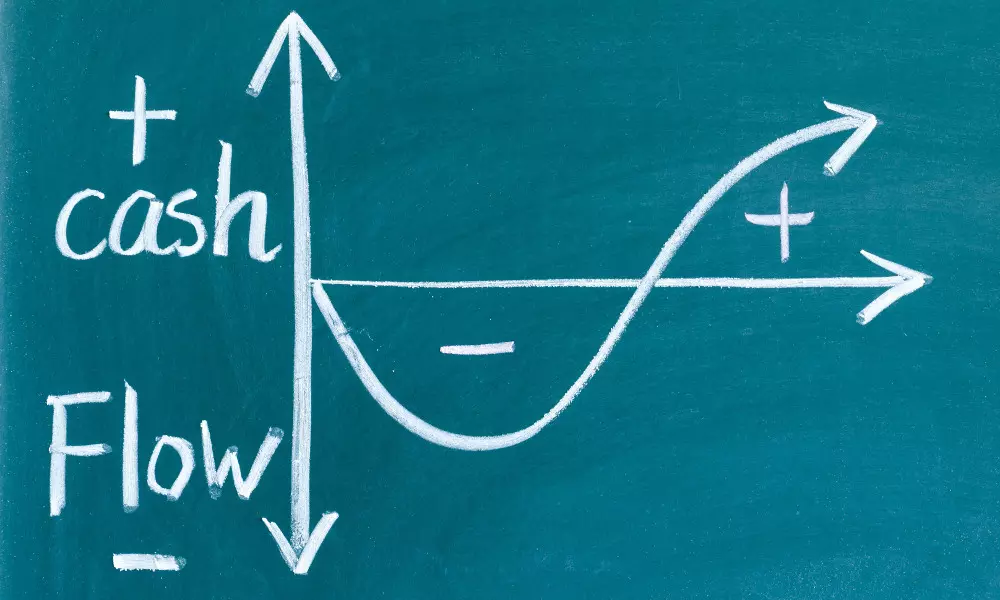

People can experience cash flow problems for various reasons, and these issues can affect individuals, businesses, and organisations. Common reasons why people might have cash flow problems: Irregular Income: People with irregular income sources, such as freelancers...

by kirstyb | Feb 27, 2023 | ATO, Business, Business Support

An area that often gets private companies into hot water, is the blurred line between the company’s money and the owner’s money. This is an area that many clients often tend to get wrong and is a frequent item on the ATO’s radar. This is what is referred to as...

by kirstyb | Nov 30, 2022 | ATO, Business, Small Business

It can be hard to know when to register GST for your business. Were here to break it down in simple terms on what do to. Many businesses in Australia are registered for Goods and Services Tax (GST) however, there are businesses that fall below the $75,000 GST...

by kirstyb | Sep 21, 2022 | Business, Business Support, Small Business

Time to Apply for a Director ID Number is now. Be Aware, Time is Running Out – 30th November 2022 is fast approaching! Director Identification Number As part of its Digital Business Plan, The Australian Government announced the full implementation of the...

by kirstyb | Sep 1, 2022 | Business, Business Support, Small Business

We have all gone through a horrid time over the past 2 and half years. As such reviewing where your business is, you may need to restart it. Here are some tips to understand if your business need a restart? Let’s Review When reviewing what has happened &...

by kirstyb | Sep 1, 2022 | Finance, Small Business, Superannuation

“Success is about creating benefit for all and enjoying the process. If you focus on this and adopt this definition, success is yours” Kelly Kim. Forget about how much you earn, whether it’s as low as a dollar an hour or if you are lucky enough to earn $1,000 dollars...