by Financially Sorted | Mar 1, 2024 | Business, Small Business

It is hard being a small business Lack of staff available, extra costs & taxes, price squeezing along with cashflow issues are just a few of the more common themes that we are hearing from our clients. The tips below are here to assist with these pressures: Get...

by Financially Sorted | Mar 1, 2024 | Business, Small Business

How to do a yearly business review There are many ways to come at a yearly business review. These days, depending on how much time and energy you have at the end of the year, you will do either a four-question review or a 20-question review. To do them properly, you...

by Financially Sorted | Oct 1, 2023 | Business, Small Business, Tax Returns

ATO is cracking down on tradies – Here’s what you need to know? Businesses can currently claim a tax exemption on work Utes and even Vans, but the ATO is cracking down on their private use. The popularity of many purchasing Utes & Vans has sparked a...

by Financially Sorted | Sep 1, 2023 | Business, Small Business, Tax & Accounting

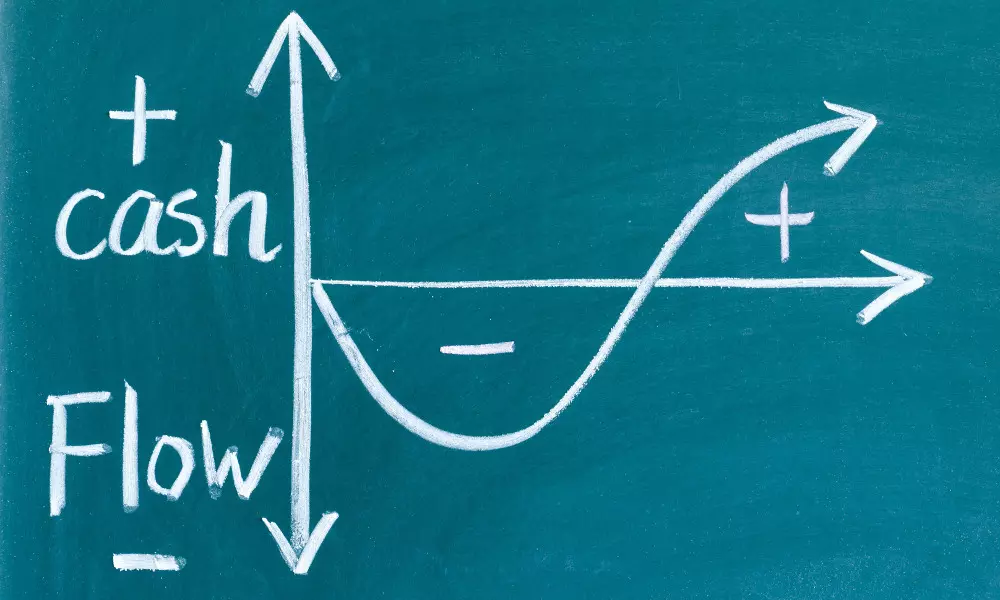

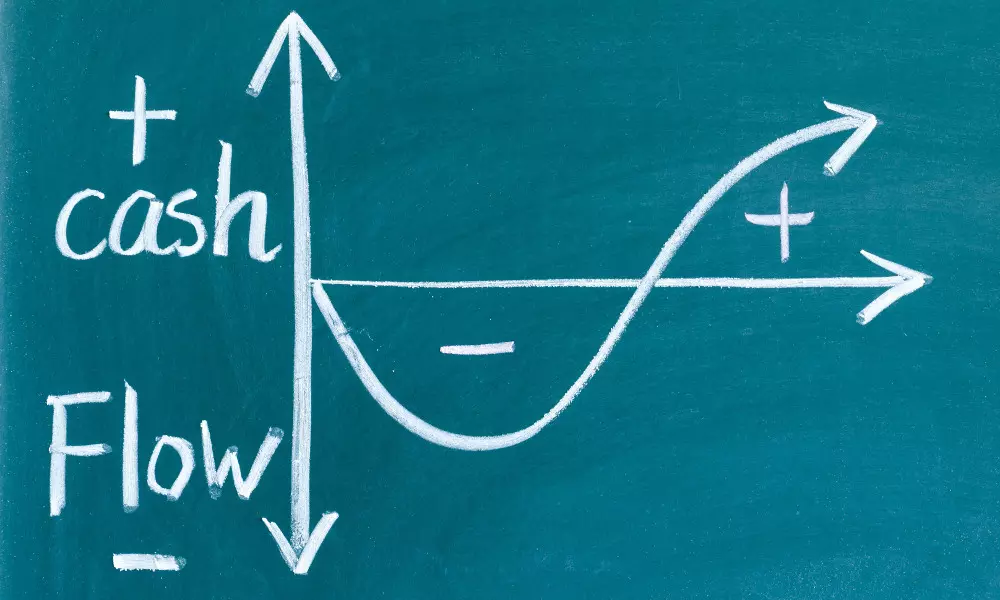

People can experience cash flow problems for various reasons, and these issues can affect individuals, businesses, and organisations. Common reasons why people might have cash flow problems: Irregular Income: People with irregular income sources, such as freelancers...

by Financially Sorted | Nov 30, 2022 | ATO, Business, Small Business

It can be hard to know when to register GST for your business. Were here to break it down in simple terms on what do to. Many businesses in Australia are registered for Goods and Services Tax (GST) however, there are businesses that fall below the $75,000 GST...

by Financially Sorted | Sep 21, 2022 | Business, Business Support, Small Business

Time to Apply for a Director ID Number is now. Be Aware, Time is Running Out – 30th November 2022 is fast approaching! Director Identification Number As part of its Digital Business Plan, The Australian Government announced the full implementation of the...