by kirstyb | Aug 8, 2024 | Property Investment, Tax & Accounting

Under the main residence exemption your family home is exempt from capital gains tax (CGT) when you dispose of it. But, like all things involving tax, is it ever that simple? A home is generally considered to be your main residence if: It is where you and your family...

by kirstyb | Jul 30, 2024 | Business, Economy, Finance, Interest Rates, Land Tax, Superannuation, Tax & Accounting, Tax Returns

Will 2024-25 be another year of volatility or a return to stability? Personal tax & super As you would be aware (at least we hope so after a $40m public education campaign), the personal income tax cuts came into effect on 1 July 2024. At the same time, the...

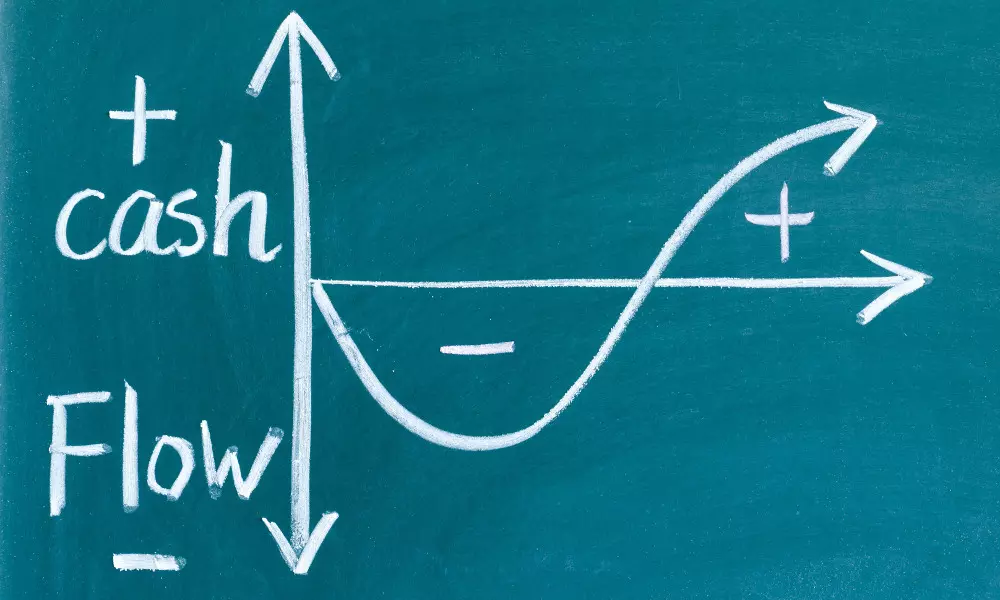

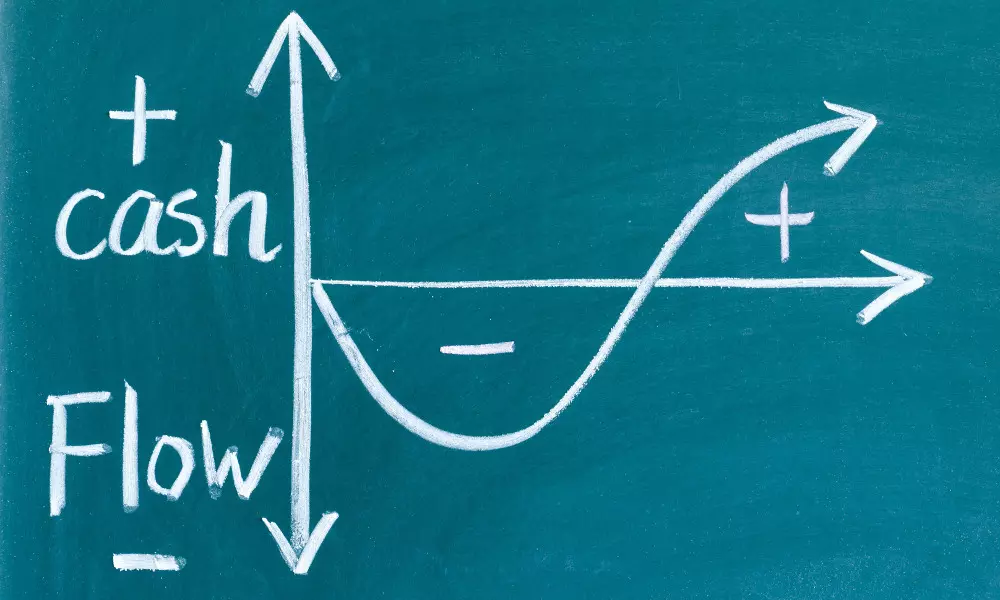

by kirstyb | Sep 1, 2023 | Business, Small Business, Tax & Accounting

People can experience cash flow problems for various reasons, and these issues can affect individuals, businesses, and organisations. Common reasons why people might have cash flow problems: Irregular Income: People with irregular income sources, such as freelancers...

by kirstyb | Sep 1, 2023 | ATO, Tax & Accounting

The ATO is on the warpath and is certainly not afraid of trying to raise some extra revenue lately. You may have recently been imposed by the ATO with General Interest Charges or Penalties due to personal circumstances for late or outstanding lodgments or possible...

by kirstyb | Sep 1, 2023 | ATO, Property Investment, SMSF, Tax & Accounting

Once again, the ATO has targeted SMSF property development schemes that divert profits of a property development project to a SMSF. This time, the focus is on using a special purpose vehicle (SPV), which the SMSF directly or indirectly owns. It appears that some SMSF...

by kirstyb | Jun 2, 2023 | Finance, Tax & Accounting

At Financially Sorted, we understand that loans can be a valuable financial tool. You can’t live with them or without them. They provide individuals and businesses with the necessary funds to achieve their goals. However there can be several problems associated with...